The pharmaceutical industry is often viewed through a dual lens. On one hand, it’s seen as a noble field focused on saving lives and innovating treatments for countless diseases. On the other, there’s undeniable corporate greed reminiscent of major Wall Street firms. This dichotomy shines brightly when examining the industry’s financial practices, especially concerning tax havens in Europe. Companies like Bristol-Myers Squibb (BMS) manage to lower their effective corporate tax rate dramatically by leveraging tax-friendly jurisdictions, making billions while patients grapple with exorbitant drug prices.

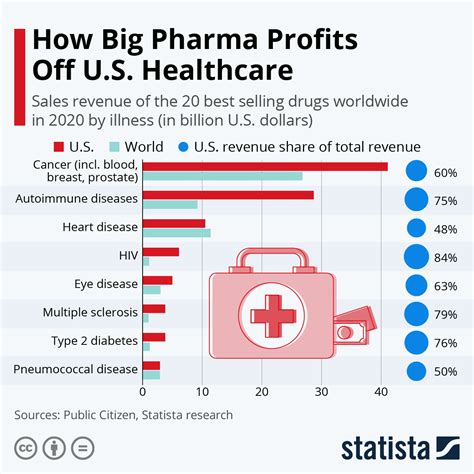

Taking a closer look, standardized corporate greed is evident. Multinational pharmaceutical firms have amassed profits of €580 billion over the last five years, a figure that starkly overshadows their research and development (R&D) expenditures. Companies often justify their sky-high drug prices by pointing to the high costs of R&D, particularly because most drugs fail at the clinical trial stage. However, the sheer volume of profits stashed away indicates that these prices do more than just cover R&D—they generate immense wealth that’s rarely reinvested into further innovation.

A comment on a related discussion pointed out that tackling pharmaceutical companies with taxes alone won’t foster drug success. This rings true when considering the high risk associated with drug development. Clinical trials, for instance, fail at alarming rates, especially within oncology where around 95% do not make it to market. These failures do offer lessons, but they invariably evaporate massive amounts of money without direct returns. Perhaps, instead of merely taxing these companies, policies should focus on ensuring that profits are reinvested ethically to foster genuine innovation.

The idea of nationalizing a protected class of life-saving medications has been floated. Such a move would drastically change the landscape, ensuring essential drugs are produced and distributed without profit-centric motives. Governments could potentially manufacture generics from expired patents, removing barriers orchestrated by monopolistic patents. Such an approach would democratize access to life-saving treatments, much like the vaccine production during pandemics where intellectual property rights were sometimes bypassed for public health reasons.

Innovative tax policies could also offer solutions. For instance, taxing corporate earnings based on where business activities and revenues are genuinely generated, rather than where companies declare their headquarters for tax purposes, could help. Reforming international regulations to prevent profit-shifting and closing loopholes would balance the scales, compelling these corporations to contribute fairly to the economies they benefit from. Countries like Ireland and the Netherlands, which have long been tax havens, could face international pressure to overhaul such practices in favor of global equity.

Public sentiment leans toward desiring more stringent regulations to curb these unethical financial maneuvers. As one comment mentioned, the public often shoulders the brunt of economic policies while corporations reap the benefits with minimal repercussions. People argue that if they have to pay their dues, so should multibillion-dollar corporations. Moreover, pharmaceutical companies aren’t alone in these practices. Tech giants and other multinational corporations also exploit the current tax framework. Comprehensive, universally enforceable policies are necessary to ensure a fairer distribution of the financial burdens and benefits within global economies.

Leave a Reply