Delving into the realm of Denmark’s societal dynamics, the discussion extends beyond idyllic impressions to uncover the underlying intricacies that shape the Danish experience. The concept of trust emerges as a central theme, woven intricately into the fabric of daily life. From allowing children to roam freely to unwavering faith in societal cohesion, trust plays a pivotal role in fostering a sense of security and community.

One of the recurrent themes in the commentary revolves around the juxtaposition of salaries and quality of life in Denmark. While acknowledging the comparatively lower salaries, residents highlight the exceptional quality of life, amplified by factors such as free healthcare, low crime rates, and robust social welfare systems. The balance between financial remuneration and overall well-being emerges as a crucial consideration for individuals weighing the pros and cons of working in Denmark.

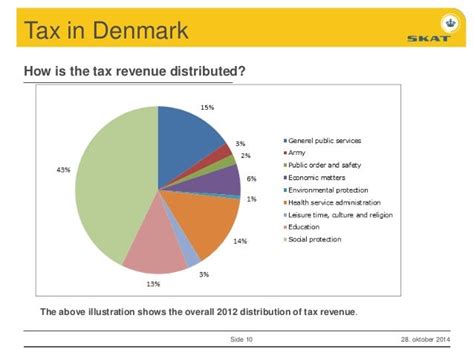

The discourse extends to the realm of taxation, shedding light on Denmark’s progressive tax system. With top-tier income tax rates reaching significant levels, discussions unravel the nuances of tax exemptions, pension schemes, and the impact on disposable income. The interplay between taxation and social benefits underscores the Danish commitment to providing comprehensive support and services to residents.

Insights into the Danish work culture offer a glimpse into a world where diligence and productivity coexist with a firm commitment to work-life balance. Observations on Danish employees’ strong work ethic contrasted with strict boundaries around work hours paint a picture of a culture that values efficiency and personal time equally. The fine line between productivity and burnout underscores the importance of holistic well-being in the Danish professional landscape.

As discussions pivot towards societal homogeneity and cultural values, varying perspectives emerge on Denmark’s identity as a culturally diverse or homogenous nation. Debates surrounding the implications of cultural unity on trust levels prompt reflections on the interplay between shared values, ethnicity, and societal cohesion. The exploration of multicultural influences in a traditionally homogeneous society unravels layers of complexity in Denmark’s social tapestry.

Moreover, the juxtaposition of home schooling practices offers a lens into contrasting approaches to education and societal norms. While highlighting the benefits of public schooling in fostering societal coherence, dissenting voices advocate for alternative educational models to cater to diverse learning needs. The tension between conformity and individual autonomy underscores broader discussions on freedom, social engineering, and educational philosophies.

Concluding the multifaceted dialogue, Denmark emerges as a tapestry of contradictions and complexities, where high levels of trust coexist with stringent tax policies, inclusive societal structures, and cultural nuances. The amalgamation of diverse perspectives and personal experiences unravels the layers of Danish society, offering a nuanced understanding of the intricacies that define the Danish experience.

By unraveling the Denmark secret through the lens of trust, taxes, and social dynamics, a deeper appreciation for the delicate balance between individual autonomy and societal cohesion emerges. The discourse surrounding Denmark’s societal intricacies serves as a testament to the multifaceted nature of high-trust societies, inviting introspection on the intricacies of trust, cultural diversity, and the societal factors that shape our collective experiences.

As the dialogue on Denmark’s societal landscape continues to evolve, the intersections of trust, taxation, and social norms offer a rich tapestry of insights into the Danish ethos. Navigating the complexities of a high-trust society, residents and observers alike grapple with the nuanced interplay of economic policies, cultural values, and social dynamics that underpin the Danish way of life.

Leave a Reply